The Pro CFO Training Course of IABM is an intensive training program in financial management and corporate governance. The course covers a number of areas, including financial analysis, financial management in line with corporate strategy, financial reporting, transparent financial disclosure, tax management, operational evaluation, and leadership and sustainable development.

Course Objectives

The course’s primary goal is to create a solid platform to train proficient CFOs who can fully satisfy the needs of the market and those enterprises that may be recruiting. That platform is based on modules that cover a wide range of topics from the rudimentary to the advanced, contributing not only to leadership abilities but also to the development, refinement, and reinforcement of the key set of competencies for future CFOs.

Who is the course for?

- Group 1: Chief Accountants, General Accountants, and Heads of Corporate Finance Departments

- Group 2: Financial Experts and investments analysts

- Group 3: Business owners or people who are managing and operating departments related to financial, and accounting operations in a company

- Group 4: Anyone with the ambition and determination to become CFO in the future

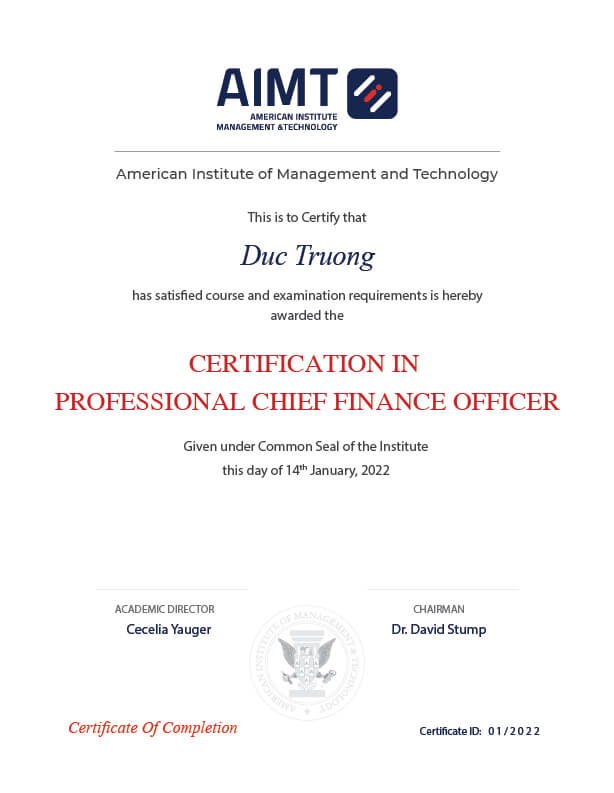

With a training program that is consulted and integrated from a set of exclusive training programs for managers from the American Institute of Management and Technology (AIMT), learners who complete one of the Director training courses at IABM will receive two valuable certificates simultaneously, including:

|

|

| Certificate issued by Institute of Accounting and Business Management (IABM) |

Certificate issued by American Institute Management & Technology (AIMT) |

Module 1: Rise to Leadership: Become a professional Chief Finance Officer

- Knowing the definitions of leadership skills

- Understand culture deeply and then apply your learnings by changing the way your recruiting team operates and even changing the culture of your recruiting teams

- Aware of how innovation helps you to achieve your goals

- Knowing how to conduct an effective professional communication strategy with stakeholders

Module 2: Strategic Management

- Defining the context of the company and building a strategic financial management road map in alignment with the company’s long-term vision

- Analyzing the Use of Strategic Management Tools and Techniques in Financial Affairs

- Learn how sustainability issues influence corporate strategy and how corporations may transform these challenges into sources of competitive advantage

Module 3: Advanced Budget Planning

- Know how to implement and evaluate budgetary planning

- Use of different methodologies in building budgetary planning

Module 4: Financial Management Reporting System

- Understanding skills for evaluating and forecasting financial sustainability

- Understanding how to use an essential toolkit for analyzing and utilizing financial statements

- Know-How to use data analysis to inform managerial decisions

- Understanding economic principles that guide your understanding of the market and the relationship between price and quantity

Module 5: Financial Analysis and Investment

- Enhancing competencies in financial performance indexes analysis

- Understanding the Grand Principles and Procedures of Financial Report

- Strengthen competencies in Financial Situation Evaluation

- Develop competencies in evaluating Portfolio Management and Wealth Planning

- Build an essential set of skills and evaluation procedures for making capital investment decisions

- Understanding the Trade Flows and International Trade Theory regarding Financial Resources and Investment Opportunities

Module 6: Business Law for Financial Executives

- Understand Business Law; Gain essential legal knowledge to guide your business’s strategic direction, mitigate risk and make better-informed leadership decisions

- Recognize the pros and cons of various business structures

- Understanding the legal duties you may have as a business leader

- Understanding the structure and components of contracts to prepare for successful business deals

- Know how to Identify practices necessary to comply with employment law

Module 7: Best Human Resource Management Practices

- Engagement and interpersonal skills development and training

- Increased awareness of team dynamics

- An understanding of your team profile and how this can be used to create dynamic teams

- Greater knowledge of team innovation and motivation

- Improved performance management skills

- Identify and develop innovation in the team, leading to the growth of talent

Module 8: Auditing for Executives

- Develop Skills in Assessment and Evaluation of Financial Performance

- Develop Skills in Financial Annual Closing Analysis

- Strengthen competencies in Planning, Auditing, and Maintaining Enterprise Systems

Module 9: Taxation and Tax Consultancy

- Understanding the Annual Tax Finalization Procedures

- Understanding Taxation Regulatory Compliances

Module 10: Internal Control and Risk Management

- Describe the historical development of corporate governance and its significance to organizations

- Identify the key characteristics of corporate governance including the role of internal audit and assurance within it

- Explain the key principles of risk management and the processes by which it is implemented

- Outline the methods used in risk identification and analysis

- Identify and explain risk treatment strategies

- Assess the relative benefits of embedded monitoring and independent assurance

- Explain the principles and mechanisms used in internal control.

Module 11: Financial Strategy Orientation and Planning

- Corporate Finance & The Objectives in Financial Decision Making

- What are Financial Decision Makings?

- Cost of Capital & Optimal Capital Structure

- Financial Ratios must understand for Financial Decision Making

- Recognize the need to adapt financial planning to changing corporate needs as well as changes in the economy and financial environment.

- Effectively analyze the comparative merits of buying and renting a home; tax implications; buying, selling, and leasing fundamentals.

- Evaluate various types of credit; understand costs and how to utilize them to the best advantage.

- Examine investment strategies considering asset allocation

| No. | Modules | Time | |

|---|---|---|---|

| Session | Periods | ||

| 1 |

Rise to Leadership: Become a professional CFO

|

1 | 4 |

| 2 |

Strategic Management, Innovation and Creativity

|

2 | 8 |

| 3 |

Advanced Budget Planning

|

3 | 12 |

| 4 |

Financial Management Reporting System

|

2 | 8 |

| 5 |

Financial Analysis and Investment Management

|

3 | 12 |

| 6 |

Financial Investment

|

3 | 12 |

| 7 |

Business Law for CFO

|

2 | 8 |

| 8 |

Effective Human Resources Management Practices for CFO

|

2 | 8 |

| 9 |

Auditing for CFO

|

2 | 8 |

| 10 |

Taxation and Tax Consultancy

|

3 | 12 |

| 11 |

Internal Control and Risk Management

|

3 | 12 |

| 12 |

Financial Strategic Orientation and Planning

|

3 | 12 |

| 13 |

Telling true stories and sharing the CFO's practical experience

|

1 | 4 |

| 14 |

Networking Event with Executives from Multinational Organizations

|

1 | 4 |

| 15 |

Workshop with Executives from Multinational Organizations

|

1 | 4 |

| 16 |

Graduation Ceremony

|

1 | 4 |

|

Total

|

33 | 132 | |

| Course | Duration | Opening | Schedule | Time |

| Pro CFO – Professional Chief Finance Officer | 20 days / 80 periods | 21/11/2022 | Mon – Wed – Fri evening | 18h00 – 21h00 |

|

Mr. Alvin Koh |

Mr. Julian Villaquiran |

Mr. Sergio Pereira da Silva |

Ms. Kel Norman |

|

Mr. Luu Khanh Truong |

Dr. Pham Ngoc Tuan |

Dr. Nguyen Van Huong |

Dr. Huynh Duc Truong |

|

Dr. Le Quang Hanh |

Mr. Le Anh Thang |

Mr. Phan Hoai Nam |

Dr. Le Ngoc Loi |

|

Mr. Bui Dang Bao |

*Required information field